Global Freight Tightens Ahead of Lunar New Year as Shippers Brace for Volatility Across Asia–U.S. Trade Lanes

Freight tightens ahead of Lunar New Year as air and intra-Asia capacity strains grow, while soft demand & compliance risks raise planning pressure for shippers

The risk isn’t just higher costs. It’s misreading when capacity tightens, when it disappears, and when it suddenly comes back.”

TAIPEI, TAIWAN, February 2, 2026 /EINPresswire.com/ -- Freight markets across Asia-Pacific are entering 2026 in a state of controlled tension, as pre-Lunar New Year shipping activity tightens air and ocean capacity while underlying demand signals remain fragile. New data from Dimerco Express Group’s February 2026 Asia-Pacific Freight Report shows that while seasonal front-loading is temporarily supporting volumes, shippers moving goods from Asia to the U.S. and Europe are facing a narrow planning window marked by rate volatility, operational risk, and growing trade compliance complexity.— Kathy Liu, VP of Global Sales and Marketing at Dimerco Express Group

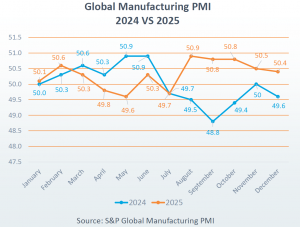

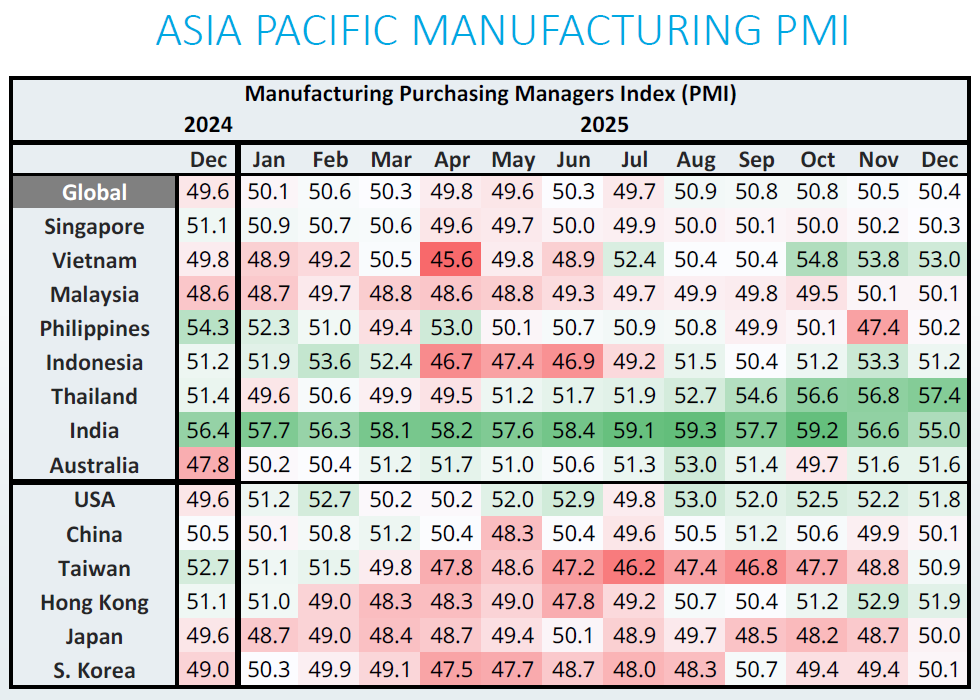

Global manufacturing ended 2025 with only marginal expansion, with the Global Manufacturing PMI hovering near 50.5, signaling cautious demand and subdued order growth heading into the first quarter of 2026. Against that backdrop, short-term freight demand in Northeast and Southeast Asia, driven significantly by high-tech cargo, is more influenced by calendar pressures than by structural recovery.

Air Freight: Seasonal Tightness Masks Softer Demand

----------------------------------------------------------------------

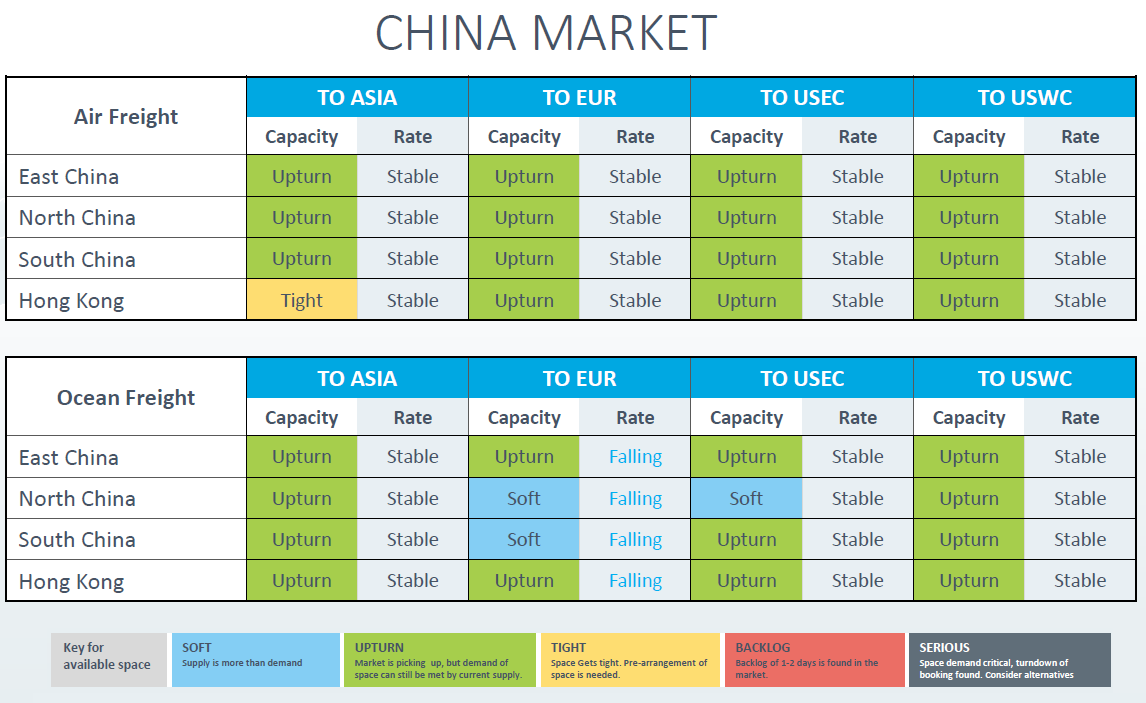

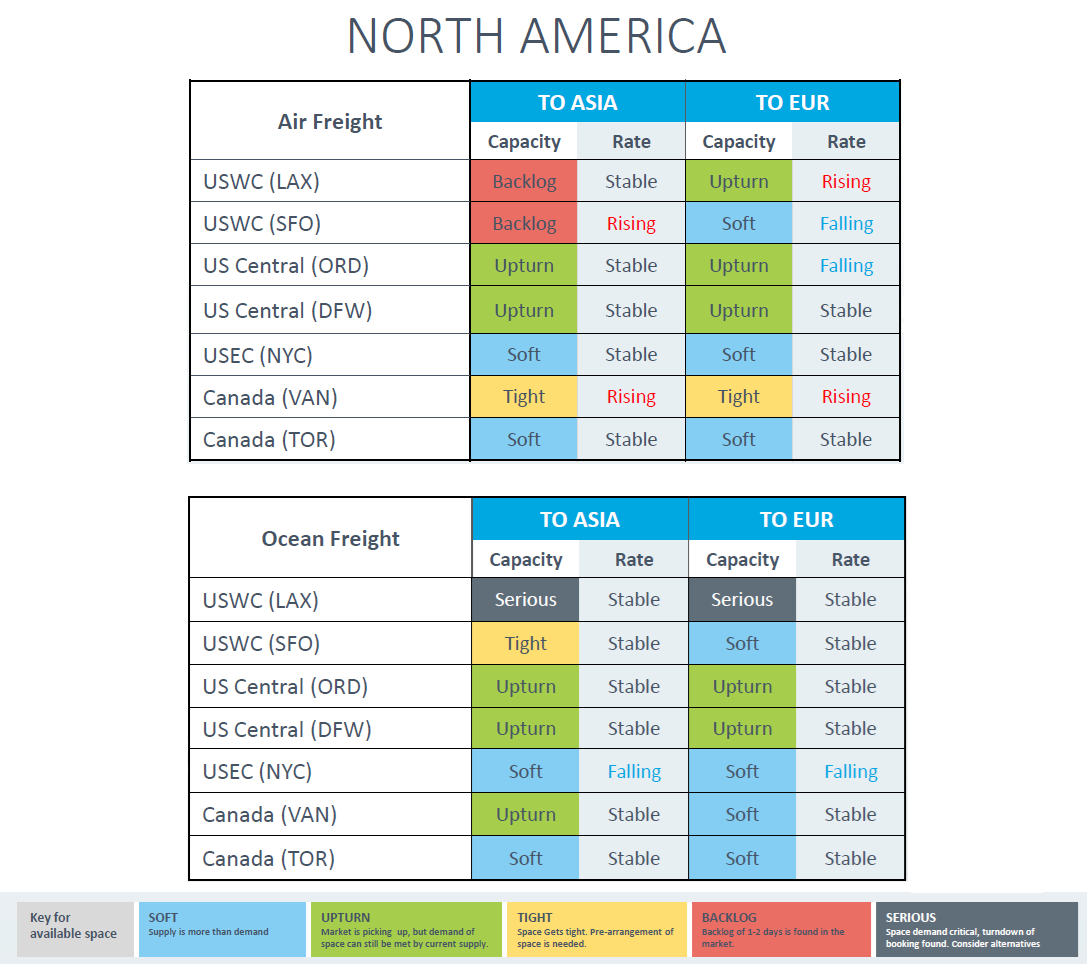

Air cargo demand from Asia to the U.S. and Europe is easing overall, with e-commerce volumes continuing to slow after January. Spot rates on transpacific and Asia-Europe lanes are largely stable or under mild downward pressure. However, intra-Asia lanes are experiencing acute capacity constraints as the Lunar New Year approaches, particularly on routes connecting China with Taiwan, Singapore, Malaysia, India, and Thailand.

Ocean Freight: Rates Hold as Carriers Defend the Floor

------------------------------------------------------------------------

On the ocean side, carriers continue to hold the line on transpacific pricing despite soft cargo demand. Rate floors are being maintained through capacity discipline rather than demand strength, with nearly half of all global blank sailings concentrated on the Transpacific Eastbound trade lane. An unusually high share that underscores cautious carrier expectations.

While Lunar New Year could offer temporary rate support, cargo volumes have yet to show a clear pre-holiday surge. The result is a market that remains vulnerable to sudden swings once factories shut and inventory digestion begins in February.

Trade Policy and Compliance Risks Rise in 2026

--------------------------------------------------------------

Beyond capacity and pricing, shippers are facing an increasingly complex compliance environment. New Section 232 tariffs targeting certain semiconductor products introduce potential 25% duties tied to technical thresholds and end-use declarations, raising the stakes for accurate classification and documentation.

At the same time, U.S. Customs and Border Protection will require all customs refunds to be processed electronically beginning February 6, 2026, a procedural shift that could disrupt cash flows for companies that are not prepared to enroll in ACH refund systems. Taken together, these changes signal that 2026 may be defined less by tariff uncertainty and more by enforcement risk.

Making Sense of a Narrow Window

----------------------------------------------

In light of these conditions, logistics decision-making is shifting from chasing short-term rate relief to focusing on timing, compliance discipline, and network flexibility.

“In this market, the risk isn’t just higher costs. It’s misreading when capacity tightens, when it disappears, and when it suddenly comes back,” said Kathy Liu, Vice President of Global Sales and Marketing at Dimerco Express Group. “Shippers that treat Lunar New Year as a single event rather than a compressed cycle are more exposed to disruption.”

Ted Chen, Director of Ocean Freight at Dimerco, added that carrier behavior is sending an important signal: “With more new vessels entering service in 2026, carriers are trying to avoid another rate war. That means capacity decisions, not demand alone, will shape outcomes on transpacific lanes.”

About Dimerco

--------------------

Dimerco Express Group integrates air and ocean freight, trade compliance, and contract logistics services to make global supply chains more effective and efficient. The majority of the company’s global logistics projects connect Asia’s logistics and manufacturing hubs with each other, and with North America and Europe. Started as an air freight forwarder in Taiwan in 1971, Dimerco now serves customers from 150+ Dimerco offices, 80 contract logistics operations, and 200+ strategic partner agents throughout China, India, Asia Pacific, North America, and Europe.

Learn more: https://dimerco.com/

For media enquiries, contact:

Stephanie Levinson

Pesti Group

stephanie.l@pesti.io

Visit us on social media:

LinkedIn

Facebook

YouTube

X

How Dimerco Powers Global Chip Supply Chains

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.