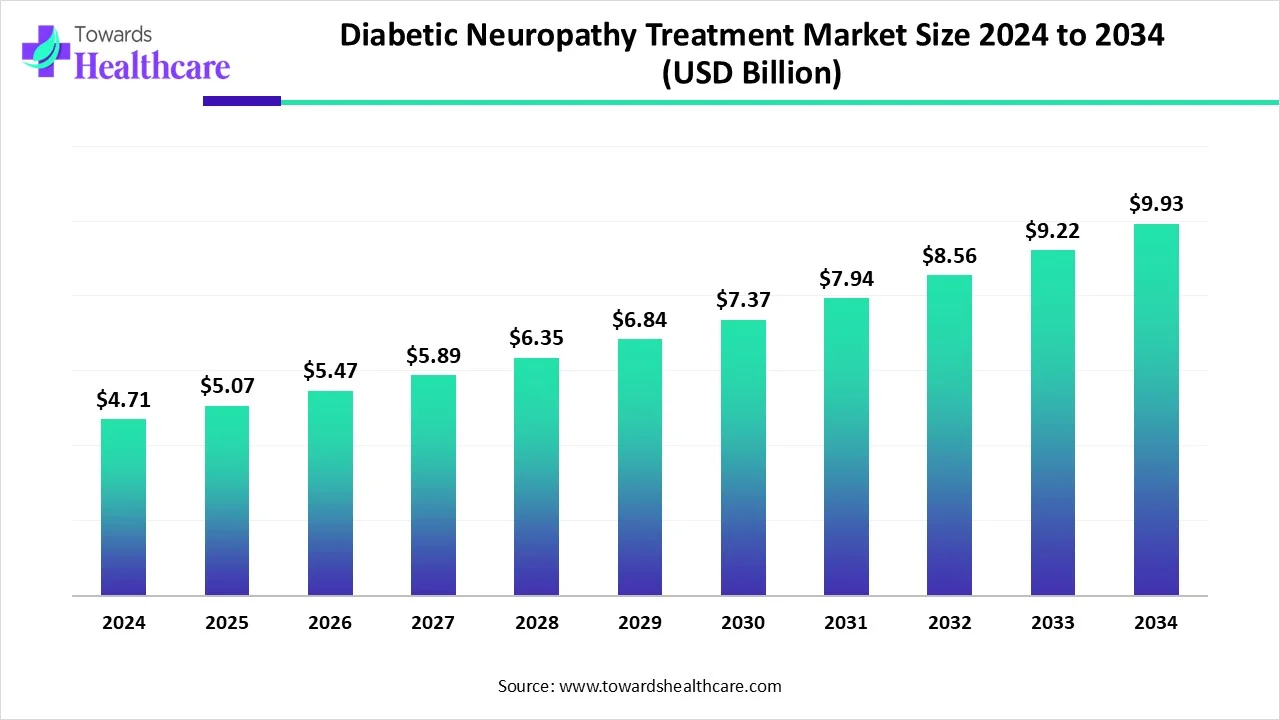

Diabetic Neuropathy Treatment Market Set to Grow from USD 4.71 Billion in 2024 to USD 9.93 Billion by 2034

The global diabetic neuropathy treatment market size was valued at USD 5.07 billion in 2025 and is predicted to hit around USD 9.93 billion by 2034, rising at a 7.75% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Feb. 04, 2026 (GLOBE NEWSWIRE) -- The global diabetic neuropathy treatment market size is calculated at USD 5.47 billion in 2026 and is expected to reach around USD 9.93 billion by 2034, growing at a CAGR of 7.75% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5608

Key Takeaways

- North America accounted for the largest share of the diabetic neuropathy treatment market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the studied years.

- By disorder type, the peripheral neuropathy segment registered dominance in the market in 2024.

- By disorder type, the autonomic neuropathy segment is expected to grow at a notable CAGR in the market during the forecast period.

- By drug class type, the non-steroidal anti-inflammatory drugs (NSAIDs) segment led the market in 2024.

- By drug class type, the opioid segment is expected to grow at a significant rate in the market during the forecast period.

- By distribution channel type, the hospital pharmacies segment dominated the market.

- By distribution channel type, the online segment is predicted to grow at a significant rate in the market during the forecast period.

What is Diabetic Neuropathy Treatment?

Medical and lifestyle interventions aimed at managing nerve damage caused by diabetes, reducing pain, improving nerve function, and preventing complications through glucose control, medications, and supportive therapies. The diabetic neuropathy treatment market is growing due to the rising global prevalence of diabetes, which increases the risk of nerve damage. Growing awareness of diabetes-related complications, advancements in pain management therapies, and the development of innovative drugs and combination treatments are driving the damage. Additionally, increasing access, aging populations, and lifestyle-related risk factors are further fueling the expansion of treatments for diabetic neuropathy worldwide.

What are the Key Drivers in the Diabetic Neuropathy Treatment Market?

Rising global diabetes prevalence, growing awareness of neuropathic complications, and increasing demand for effective pain management are primary drivers. Advances in drug development are primary drivers. Advancements in drug development, the availability of combination therapies, and expanding healthcare infrastructure also boost market growth. Additionally aging population and lifestyle-related risk factors contribute to higher treatment adoption worldwide.

For Instance,

-

In April 2025, NeuroPro™ launched an upgraded foot massager that helps relieve diabetic neuropathy pain, burning, and tingling with just 15 minutes of daily use.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Ongoing Trends in the Diabetic Neuropathy Treatment Market?

- In March 2025, Lexicon Pharmaceuticals reported encouraging Phase 2b trial outcomes for pilavapadin (LX9211), an oral, non-opioid AAK1 inhibitor. The investigational therapy demonstrated potential benefits in adults suffering from moderate to severe diabetic peripheral neuropathic pain.

- In October 2024, Lyka Labs received CDSCO approval to manufacture and commercialize Pregabalin Gel 8% w/w for managing diabetic neuropathy pain. The topical formulation is intended to relieve nerve-related pain caused by diabetic nerve damage, offering a targeted treatment option for affected patients.

What is the Emerging Challenge in the Diabetic Neuropathy Treatment Market?

The diabetic neuropathy treatment market faces challenges such as limited disease-modifying therapies, variable patient response to pain medications, side-effect concerns, high treatment costs, and difficulties in early diagnosis, which hinder optimal disease management and long-term patient outcomes.

Regional Analysis

What Made North America Dominant in the Diabetic Neuropathy Treatment Market in 2024?

North America dominated the market in 2024 due to the high prevalence of diabetes, strong awareness of neuropathic complications, and early diagnosis rates. The region benefits from advanced healthcare infrastructure, rapid adoption of innovative therapies, and significant R&D investments. Favorable reimbursement policies, strong presence of leading pharmaceutical companies, and widespread access to prescription medications and pain management solutions further reinforced North America’s market leadership.

How did the Asia Pacific Expand At the Fastest Pace in the Market in 2024?

Asia Pacific expanded at the fastest pace in the neuropathy treatment market in 2024 due to the rapidly rising diabetic population, increasing healthcare awareness, and improving access to diagnosis and treatment. Growth in healthcare infrastructure, expanding pharmaceutical manufacturing, and greater availability of affordable therapies supported adoption. Additionally, supportive government initiatives, rising healthcare spending, and growing acceptance of advanced and alternative treatment options across emerging economies accelerated regional market expansion.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By Disorder Type Analysis

How did the Peripheral Neuropathy Segment Dominate the Diabetic Neuropathy Treatment Market in 2024?

The peripheral neuropathy segment dominated the diabetic neuropathy treatment market in 2024 because it is the most common and clinically significant form of diabetic nerve damage. High prevalence among long-term patients, frequent symptoms such as pain, numbness, and tingling, and the need for continuous pain management drove demand. Wide availability of approved drug therapies, topical treatments, and medical devices further supported the segment’s leading market share.

The autonomic neuropathy segment is expected to grow at a notable CAGR during the forecast period due to increasing recognition of diabetes-related autonomic complications affecting cardiovascular, gastrointestinal, and urogenital functions. Improved diagnostic capabilities, rising clinical awareness, and growing focus on comprehensive diabetes management are driving demand. Additionally, ongoing research, development of targeted therapies, and rising prevalence of long-term diabetes cases are supporting faster adoption of treatments for autonomic neuropathy.

By Drug Class Type Analysis

Why Non-steroidal Anti-inflammatory Drugs (NSAIDs) Segment Dominated the Diabetic Neuropathy Treatment Market?

The non-steroidal anti-inflammatory drugs (NSAIDs) segment dominated the market due to their widespread use for managing mild to moderate neuropathic pain and inflammation. Easy availability, affordability, and rapid pain-relief effects made NSAIDs a common first-line option, especially in early disease stages. Their broad physician familiarity, over-the-counter accessibility in many regions, and use alongside other therapies further supported high adoption across diverse patient populations.

The opioid segment is expected to grow at a significant CAGR during the forecast period due to increasing use in managing severe and treatment-resistant diabetic neuropathic pain. For patients unresponsive to conventional therapies, opioids provide effective pain control and improved quality of life. Growing clinical acceptance for short-term and controlled use, availability of newer formulations with improved safety profiles, and rising cases of advanced neuropathy are further supporting segment growth.

By Distribution Channel Type

How did the Hospital Pharmacies Segment Dominate the Market in 2024?

The hospital pharmacies segment dominated the diabetic neuropathy treatment in 2024 due to the high rate of hospital visits for diagnosis, pain management, and treatment of diabetes-related complications. Availability of prescription-based therapies, specialized supervision, and access to advanced medications supported higher dispensing through hospitals. Additionally, integrated care settings, better reimbursement coverage, and trust in hospital-based treatment channels reinforced the segment’s leading market share.

The online segment is expected to grow at a significant rate due to increasing rate due to increasing digital health adoption and patient preference for convenient medicine access. Rising use of e-pharmacies, home delivery services, and teleconsultations supports easier prescription refills and chronic pain management. Competitive pricing, wider product availability, and improved regulatory framework for online pharmacies further encourage adoption, especially among tech-savvy and urban populations.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

What are the Recent Developments in the Diabetic Neuropathy Treatment Market?

- In November 2024, Eva Pharma expanded into Nigeria by launching a portfolio of diabetes-related therapies aimed at improving access to affordable, high-quality care. The lineup includes Gliptus Plus for blood sugar control, Thiotacid for diabetic neuropathy management, and Donifoxate for hyperuricemia and gout, unveiled during a product launch event held in Lagos.

- In January 2024, Neuralace Medical received U.S. FDA clearance for its Axon Therapy device, designed to manage chronic painful diabetic neuropathy. The non-invasive neuromodulation technology provides an alternative option for patients seeking drug-free relief from diabetes-related nerve pain.

Diabetic Neuropathy Treatment Market Key Players List

- Pfizer. Inc

- Abbott

- Janssen Pharmaceuticals, Inc

- Eli Lilly and Company

- Glenmark Pharmaceuticals Ltd

- Lupin Pharmaceuticals

- Novartis

- Astellas Pharma Inc

- Boehringer Ingelheim GmbH

Browse More Insights of Towards Healthcare:

The global cervical cancer treatment market size is calculated at US$ 8.65 in 2024, grew to US$ 9.12 billion in 2025, and is projected to reach around US$ 14.68 billion by 2034. The market is expanding at a CAGR of 5.44% between 2025 and 2034.

The global acne treatment market is expected to grow from USD 11.03 billion in 2025 to USD 16.82 billion by 2034, with a CAGR of 4.8% throughout the forecast period from 2025 to 2034.

The global mental health treatment market size was estimated at USD 66.78 billion in 2025 and is predicted to increase from USD 71.22 billion in 2026 to approximately USD 127.13 billion by 2035, expanding at a CAGR of 6.65% from 2026 to 2035.

The global brain tumor treatment market size was estimated at USD 3.58 billion in 2025 and is predicted to increase from USD 3.84 billion in 2026 to approximately USD 7.21 billion by 2035, expanding at a CAGR of 7.24% from 2026 to 2035.

The global sleeping bruxism treatment market size was estimated at USD 611.07 million in 2025 and is predicted to increase from USD 652.8 million in 2026 to approximately USD 1183.1 million by 2035, expanding at a CAGR of 6.83% from 2026 to 2035.

The hair treatment drug market was estimated at US$ 1.4 billion in 2023 and is projected to grow to US$ 2.99 billion by 2034, rising at a compound annual growth rate (CAGR) of 7.14% from 2024 to 2034.

The huntington's disease treatment market is projected to reach USD 1519.02 million by 2035, growing from USD 716.79 million in 2025, at a CAGR of 7.8% during the forecast period from 2026 to 2035.

The global hematuria treatment market size is calculated at USD 1.13 billion in 2025, grew to USD 1.17 billion in 2026, and is projected to reach around USD 1.55 billion by 2035. The market is expanding at a CAGR of 3.15% between 2026 and 2035.

The global food allergy treatment market size is calculated at USD 6.9 billion in 2024, grew to USD 7.47 billion in 2025, and is projected to reach around USD 15.32 billion by 2034, expanding at a CAGR of 8.3% between 2025 and 2034.

The fibromyalgia treatment market size is expected to grow from USD 3.01 billion in 2025 to USD 4.59 billion by 2035, with a CAGR of 4.3% throughout the forecast period from 2026 to 2035.

Segments Covered in the Report

By Disorder Type

- Peripheral Neuropathy

- Autonomic Neuropathy

- Proximal Neuropathy

- Focal Neuropathy

By Drug Class

- Capsaicin

- Opioid

- Morphine

- Others

- Non-Steroidal Anti-inflammatory Drugs (NSAIDs)

- Ibuprofen

- Naproxen

- Others

- Antidepressants

- Tricyclic Antidepressants (TCAs)

- Amitriptyline

- Imipramine

- Others

- Serotonin and Norepinephrine Reuptake Inhibitors (SNRIs)

- Duloxetine

- Others

- Selective Serotonin Reuptake Inhibitors (SSRIs)

- Citalopram

- Paroxetine

- Others

- Anticonvulsant Drugs

- Gabapentin

- Pregabalin

- Topiramate

- Others

- Tricyclic Antidepressants (TCAs)

- Other

By Distribution Channel

- Hospitals Pharmacies

- Retail Pharmacies

- Other

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5608

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Also Read:

https://www.towardshealthcare.com/insights/surgical-microscopes-market-sizing

https://www.towardshealthcare.com/insights/iv-bags-market-sizing

https://www.towardshealthcare.com/insights/multiple-sclerosis-diagnosis-and-treatment-market-sizing

https://www.towardshealthcare.com/insights/atrial-fibrillation-treatment-market-sizing

https://www.towardshealthcare.com/insights/cutaneous-squamous-cell-carcinoma-treatment-market-sizing

https://www.towardshealthcare.com/insights/tendonitis-treatment-market-sizing

https://www.towardshealthcare.com/insights/diabetic-neuropathy-treatment-market-sizing

https://www.towardshealthcare.com/insights/oral-diabetes-medicine-market-sizing

https://www.towardshealthcare.com/insights/spinal-cord-injury-treatment-market-sizing

https://www.towardshealthcare.com/insights/infertility-treatment-market-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.